Assumption of Constant Volatility and Market Crashes

A major shortcoming of the Black-Scholes model is the assumption that the volatility of an asset remains constant over time, which means fluctuations in an assets price occur stably. This does not reflect real-world financial markets which demonstrate changing volatility due to factors such as financial crises or geopolitical tensions. Volatility often substantially spikes during market distress, resulting in large price instabilities. The Black-Scholes model cannot consider shifting velocities which produces inaccurate option prices. [1]

Changing Interest Rates

The risk-free interest rate, , is assumed to remain constant throughout the option. However, interest rates do not remain fixed due to monetary policies because of the ever-changing economic climate. Interest rates drop during recessions to encourage spending which stimulates economic growth. On the contrary, they rise to slow down the economy when inflation increases. Why is this problematic? Not considering interest rates disadvantages traders who use leverage to buy options which lowers demand for options. Additionally, the price of long-term options is also sensitive to changes in interest rates. Therefore, not being able to account for dynamic interest rates results in mispriced options or unexpected costs. [1]

Log-Normal Distribution

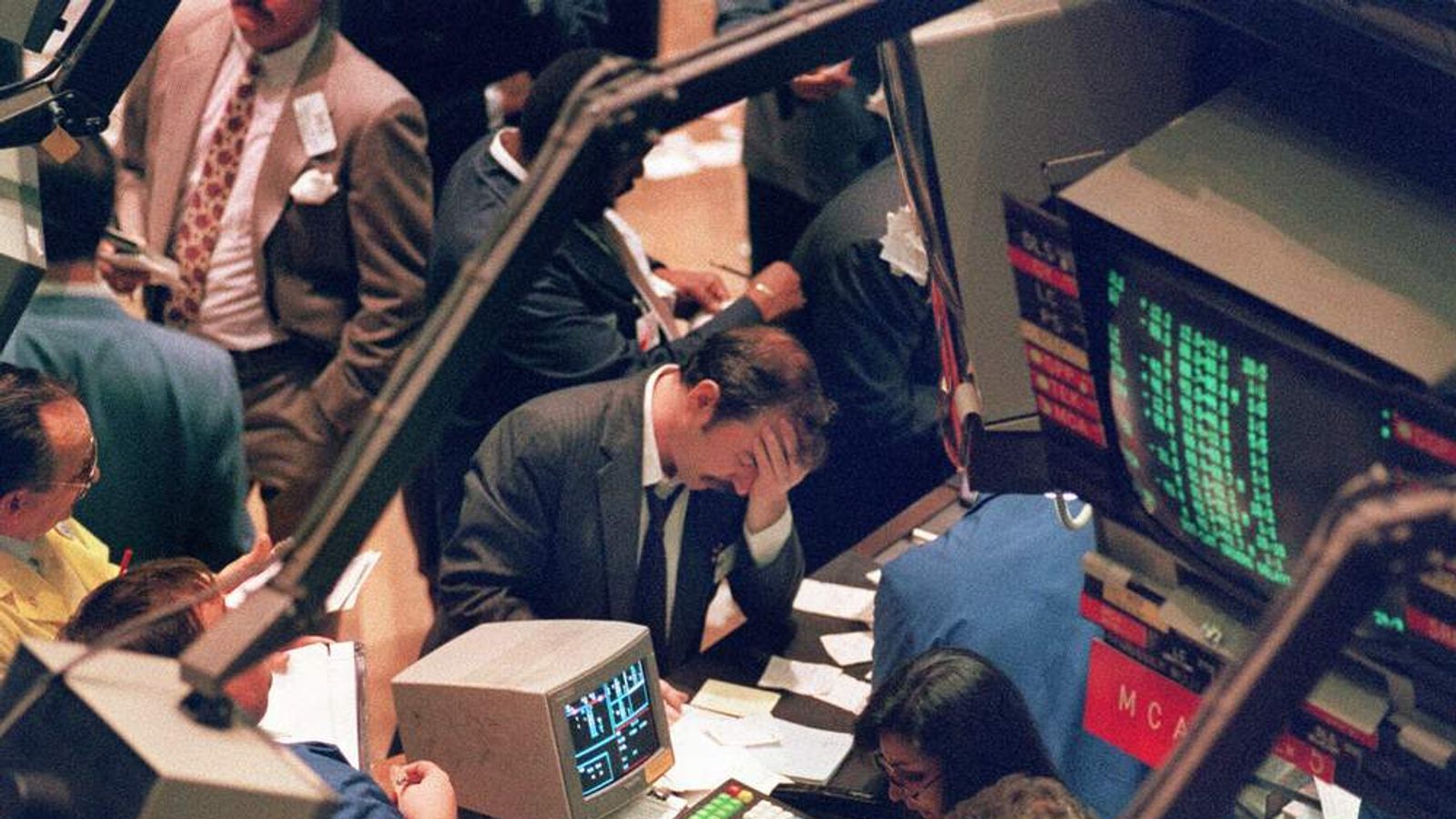

Following from geometric Brownian motion, asset prices are assumed to change smoothly with very small fluctuations over time following a log-normal distribution. What this means is that the model does not consider big jumps in the market. This doesn’t work because time and time again we have seen drastic changes in markets following major world events. The model wouldn’t have been able to account for the crashes that occurred during the 2008 financial crisis or COVID-19 induced market crash.

Frictionless Market

The Black-Scholes model assumes that traders can buy and sell without any transaction costs or taxes. The model also assumes that the market is always liquid enough for large volumes of trades to take place at any given time without affecting the price. Many institutions use hedging strategies such as delta hedging which incorporates the Black-Scholes framework to reduce risk exposure, which is the likelihood of an asset or organization experiencing a loss. This strategy requires constantly buying and selling stocks, leading to accumulated fees, which makes the approach not as effective. [2]

Cannot Price American Options

The model was specifically designed for European-style options which are strictly exercised at expiration. However, many options today are American-style, which can be exercised before expiry. As the Black-Scholes model does not take this into account, it is ineffective for pricing American-style options. [3]

References:

[2] Derman, E. and Miller, M.B., 2016. The volatility smile. John Wiley & Sons. ISBN: 9781118959169

[3] Quail, R., 1995. Understanding options. John Wiley & Sons, pp.47-48 ISBN: 9780071476362